Distribution effects of fiscal policy on income and employment: Microeconomic evidence for Austria

DIEFISCAL is a collaborative project between the Chair of Macroeconomics at Chemnitz University of Technology and the Vienna Institute for International Economic Studies funded by the Austrian Academy of Sciences.

Funding institution

Duration

July 2025 - June 2027

Project partner

Vienna Institute for International Economic Studies

Research question

This project provides new insights into how changes in tax and social legislation affect individual income and employment trajectories

Methods

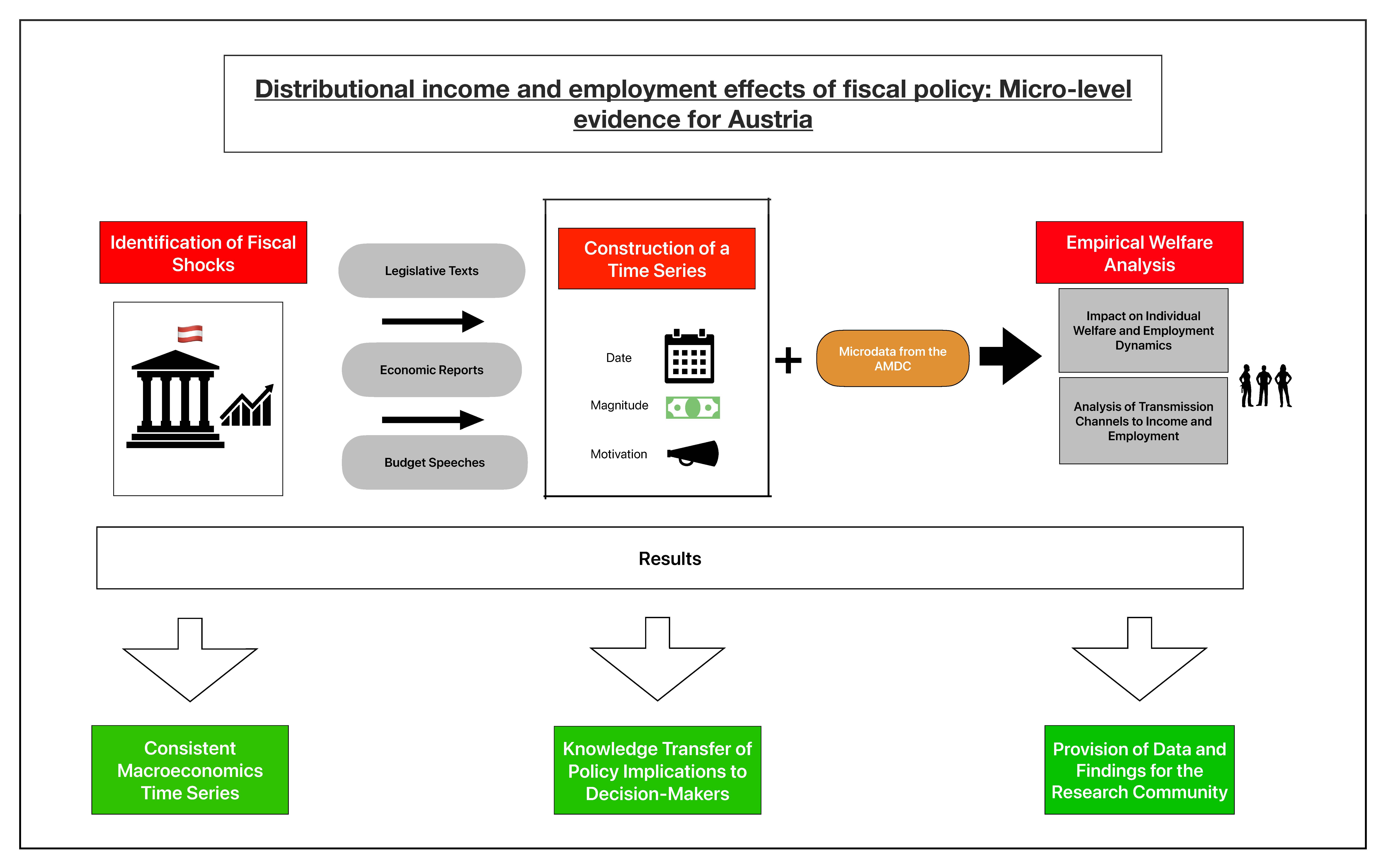

The identification of exogenous fiscal policy shocks is central to the causal analysis of the effects of tax and transfer policy changes on income and employment levels. We therefore record exogenous tax and transfer shocks for Austria in a broad historical time series.

This novel data set includes the timing, size, motivation, and distributional impact of statutory tax and transfer changes in the period 2000-2022, based on information from government bills, budget reports, the finance minister's annual budget speech in the Austrian parliament, press reports, and economic reports. This dataset is published as open source and can therefore be used by other researchers for further research questions at the national level. It can also be combined with similar datasets for other countries in international panel studies or country comparisons.

We apply this narrative dataset to microdata from the Austrian Micro Data Center (AMDC) on income and employment. This allows us to test whether different policy measures (e.g., income tax reforms, changes in consumer taxes, or social benefits) have different effects on individual income and employment developments.

Combining the AMDC microdata with our macroeconomic dataset on fiscal shocks enables high-frequency identification of the effects of tax and transfer shocks at the individual level. These individual tax and transfer shocks can then be tested as possible explanations for employment trajectories, reasons for unemployment, and decisions on working hours depending on the social and economic status of the individual.

Project objectives

Our results will inform policymakers about the effects of different tax and transfer policies on employment and income development in Austria, including with regard to the use of regional differences. These findings will contribute to the scientific literature on the effects of fiscal policy. In particular, we will gain new insights into the transmission mechanisms of tax and transfer shocks via decisions on labour supply and demand, which are not yet well understood. The estimated parameters can be incorporated into modern macroeconomic heterogeneous agent models.