Research project "Monetary Policy and Energy Prices"

Cooperation project between the Chair of Macroeconomics and the Vienna Institute for International Economic Studies on the impact of monetary policy and energy prices. The project is funded by the European Macro Policy Network (EMPN), an international research network headed by the Dezernat Zukunft.

The project aims to develop well-founded statements based on the state of scientific knowledge on two current and economic policy problems. On the one hand, the project considers the effect of energy price changes on consumption and related CO2 emissions and, on the other hand, the effect of (conventional) monetary policy on growth, prices and employment.

Sub-project 1: Do monetary policy shocks affect output, employment, and prices? Meta-analyses on the effects of conventional monetary policy

There is an extensive literature on the effects of policy rate control on macroeconomic variables. The effects found in the individual studies are widely scattered and in some cases contradict each other. We therefore collect the existing empirical evidence and evaluate it using meta-analysis tools.

In addition, we examine whether the effects are regime-dependent, in particular:

- whether they vary over the business cycle;

- consider temporal and spatial characteristics of monetary policy episodes or monetary policy in the euro area;

- look at potential asymmetries in the effects of interest rate increases and decreases; and

- check for systematic differences between central bank studies and other publications.

Sub-project 2: CO2 Pricing and the Elasticity of Heating and Cooling Energy Demand: A meta-analysis

We use another meta-study to determine the steering effects of CO2 pricing on fossil fuel demand and its determinants. Therefore, we investigate the price elasticities of fossil fuel demand, focusing on heating and cooling energy sources, which represent the largest final energy consumption in households, industry, and other applications, accounting for about 50% of total global energy demand, and include natural gas, liquefied petroleum gas (LPG), coal, fuel oil, and electricity.

The meta-analysis aims to systematize existing, widely varying estimates of demand elasticities, identify potential confounding and influencing factors (e.g. study design, type of energy source, sector of interest or market vs. policy price changes), and derive conclusions about the effectiveness of CO2 pricing on a broad data set.

In particular, we are interested in:

- how price-elastic the demand for (various) fossil fuels is,

- which factors systemically influence price elasticity and

- how an effective CO2 taxation affects price elasticity?

Project process

In both subprojects we conduct a meta-analysis. More details on how to use this tool can be found here. In our project we proceed as follows:

- collection of literature

- online libraries (e.g. Google Scholar or EconLit)

- already published studies

- snowballing

- Title and abstract screening

- Full text screening

- Extract data from the studies

- Data analysis

- Publishing

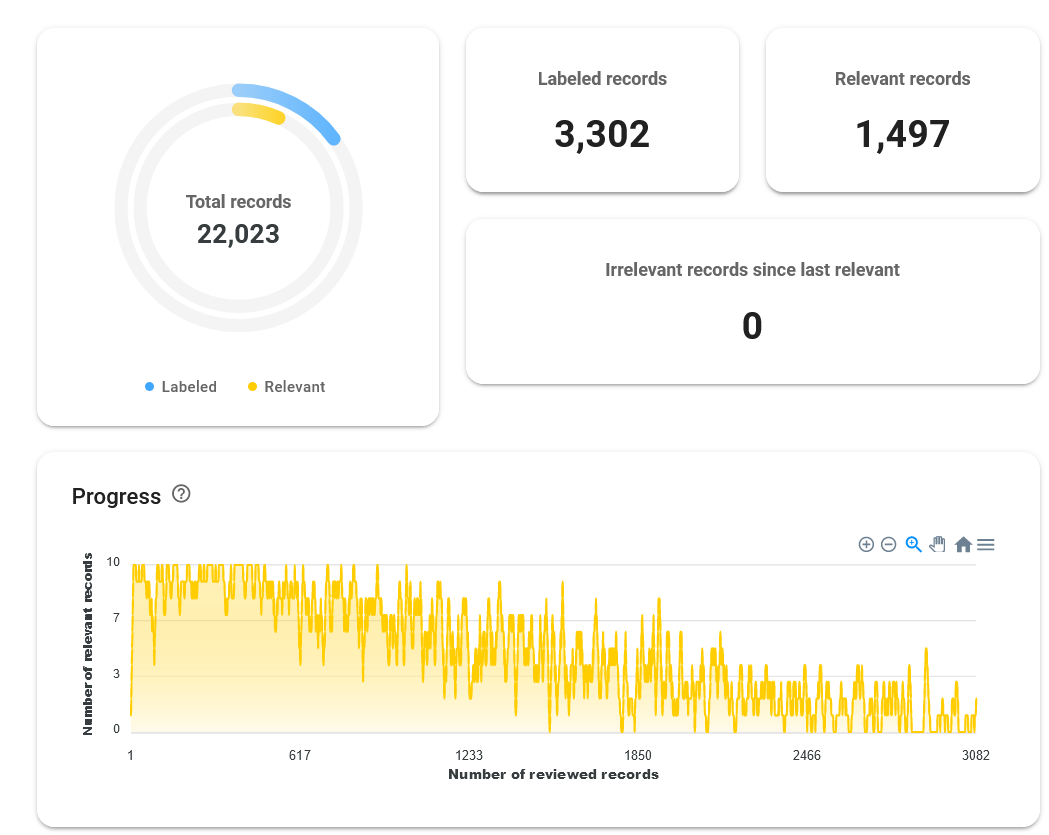

Depiction of the abstract screening process with the open-source software ASR-Review

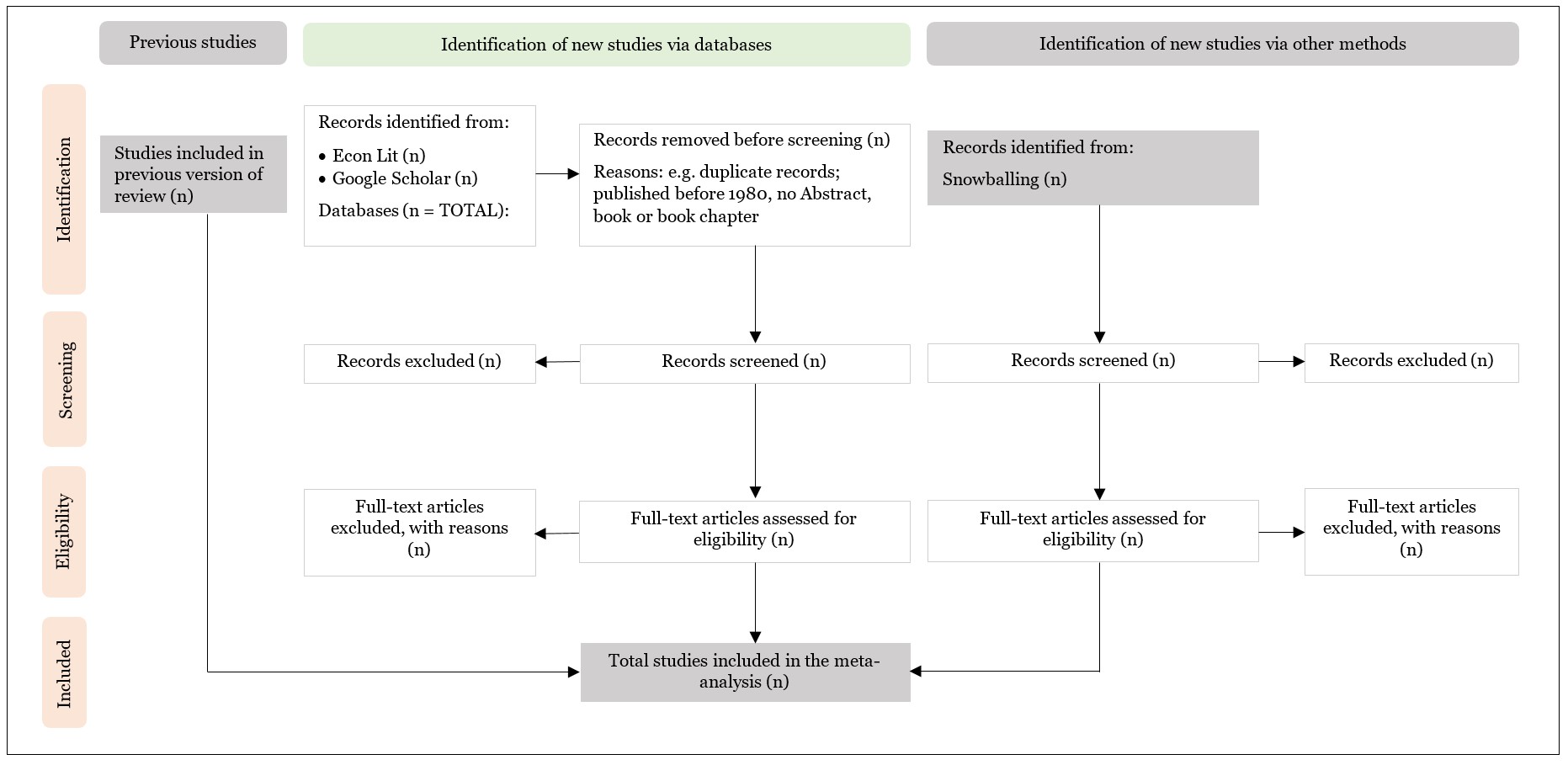

The process of collecting literature using the PRISMA flow chart

Project objectives

We want to use our results to

- develop recommendations for action for policy-makers,

- policy papers or blog posts,

- participate in conferences,

- and to make the topics accessible to an interested public

Interested students can prepare a bachelor's or master's thesis within the project at any time.