Light E-Commercial Vehicles – A “Sleeping Giant” Wakes

Current joint study by CATI and automotive thüringen shows prospects for the electrification of light commercial vehicles

In the passenger car sector, a sustained trend toward electromobility began in 2020. This is not the case for light commercial vehicles - a market segment in which diesel engines still dominate the drive mix by 90 percent in Europe. Electric vehicles, on the other hand, with a market share of 1.2 percent, are only a niche player – this is also true for vehicles that are a major component of urban mobility. What are the reasons for this unsatisfactory state of affairs, and where will the journey take us in the coming years?

The Chemnitz Automotive Institute CATI, a division of the TUCed - An-Institut für Transfer und Weiterbildung GmbH at Chemnitz University of Technology, has investigated how the "sleeping giant" is awakening from its niche existence and what prospects this segment has. The study was conducted on behalf of and in cooperation with the automotive thüringen network.

Grace period for economical diesel ends

Light commercial vehicles up to 3.5 tons gross vehicle weight are particularly used in the areas of delivery services, trade, services, construction, and municipal operations. As a result, economy of use is a top priority. Factors such as purchase price, operating costs, lifespan, space, payload, range, etc. - in conjunction with the infrastructural framework conditions - represent a high market barrier to the use of electric light commercial vehicles. In addition, the extremely moderate CO2 limits for light commercial vehicles until 2020/2021 have so far been unable to trigger a trend reversal toward low-emission drives. To date, diesel engines have dominated the market with a share of more than 90 percent. This grace period is now over. The limits now set by the EU for 2025 and 2030 can no longer be achieved with the current drive mix.

Manufacturers are reacting. European automakers are doubling their range of electric light commercial vehicles in 2020/2021. In addition, newcomers and start-ups are entering this market. The latter applies particularly in the USA and Great Britain, where young companies such as Rivian and Arrival have the necessary capital resources on a completely different scale, while in Germany the pioneer StreetScooter is on its last legs.

In 2020, despite the industry crisis, new registrations of battery-electric light commercial vehicles increased by 40 percent, although the original rate was quite low. As a result, the CATI study expects annual growth of 25 percent for electric light commercial vehicles by 2030. Fuel cell vehicles continue to play no role. In 2020, 14 vehicles with this drive technology were newly registered across Europe, compared with one in 2019.

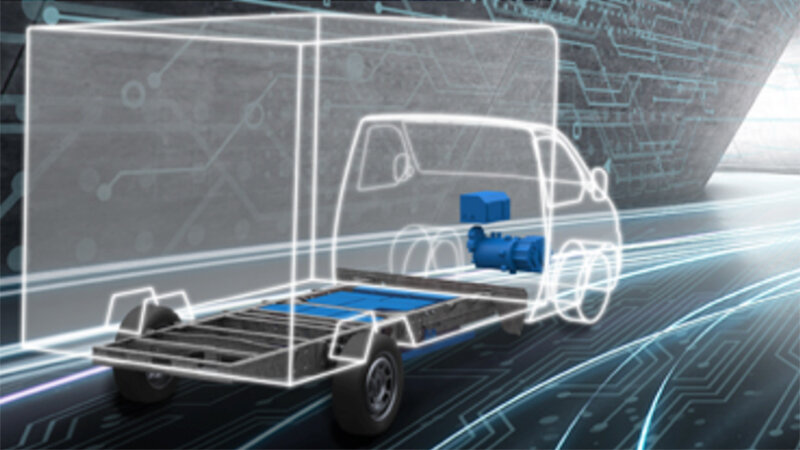

Trends toward platforms, modularization, and lightweight construction

According to CATI authors Prof. Dr. Werner Olle and Dr. Daniel Plorin, three technological trends currently being driven by manufacturers and startups are of fundamental importance for overcoming the market barriers for electric light commercial vehicles: First, new platform structures (skateboarding/rolling chassis) that offer optimal usable space and allow high volumes and thus cost degression through scalability; second, modularization of vehicle architecture and bodies that contribute to cost and investment reduction (through an increase in common parts as well as the possibility of reducing the number of vehicles for fleet operators); and third, lightweight construction in vehicles and bodies to compensate for additional weights from new powertrains to secure payloads.

Conclusion: New regulatory requirements on CO2 limits will change the market

Electromobility has so far only been of secondary importance in light commercial vehicles. However, thanks to the new regulatory requirements on CO2 limits, this will change intensively for this vehicle segment overall in the next few years. Individual large companies close to customers, such as Deutsche Post/DHL, are already going a step further with their current announcement to increase the share of electric delivery vehicles to 60 percent by 2030. The market for light commercial vehicles has now awakened as the "sleeping giant" of electromobility. This has implications for manufacturers, suppliers and, as a special feature of commercial vehicles, for body manufacturers, of which there are 10,000 companies across Europe.

An abridged version of the study can be requested at www.cati.institute/studien.

Contact: Prof. Dr. Werner Olle, Director CATI, phone: 0151 64303476, e-mail: werner.olle@cati.institute, and Rico Chmelik, Managing Director automotive thüringen, phone: 0162 3829405, e-mail: rchmelik@automotive-thueringen.de

Keyword: Chemnitz Automotive Institute CATI

Founded in 2015, the Chemnitz Automotive Institute (CATI) is a division of a Chemnitz University of Technology-affiliated institute, TUCed - An-Institut für Transfer und Weiterbildung GmbH. Automotive structural change is a research focus of CATI. The focus is especially on holistic cross-sectional and impact analyses. CATI cooperates with automotive networks as well as practical partners from industry, research, and continuing education. Through TUCed, there is also close interaction with other Chemnitz University of Technology institutes.

Keyword: automotive thüringen e.V. (at)

The network automotive thüringen e.V. has about 100 member companies, which generate a revenue of about four billion euros with about 30,000 employees. This network has set itself the task of supporting member companies in new developments, projects, and innovations relating to mobility. As the mouthpiece and network partner for automotive suppliers, automotive thüringen also provides support in the form of training courses tailored to the needs of member companies. The annual automotive thüringen industry day serves to promote dialogue between industry, science, and politics.

(Source: Joint announcement by CATI and automotive thüringen)

(Author: Mario Steinebach / Translation: Chelsea Burris)

Matthias Fejes

06.04.2021