Beware of Data Disclosure

Social media study at the TU Chemnitz shows: the majority of Facebook users would embellish their profiles to improve their credit rating

-

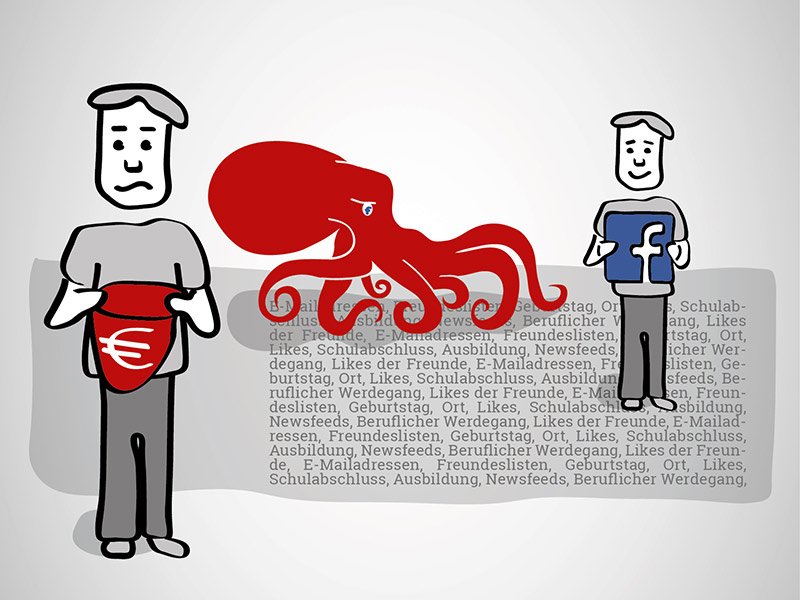

Many Facebook users are cautious when banks request access to their personal information in order to calculate their credit rating. The “Datenkrake”, or Data Octopus, is a visual metaphor used in Germany to represent data disclosure of this kind. Graphic: Jacob Müller

How do Facebook users react when banks inspect their private profiles to determine their credit scores? In 2016, the Professorship of Banking and Corporate Finance at the TU Chemnitz conducted a study devoted to answering this question, carried out with support from students studying in the Finance Master’s degree program. Dr. Friedrich Thießen reports that “Big Data makes it possible to analyze immense amounts of personal information in a targeted fashion in order to analyze aspects of a person’s credit rating.” Even Facebook is working on this. But start-up companies like Kreditech or Big Data Scoring are also pursuing similar goals, according to Annamarie Kühn, member of the student research team. “This trend towards evaluating every possible kind of data resource for commercial purposes is generally an unstoppable development,” adds student Marianne Nake.

Chemnitz-based financial experts are investigating two central research questions in their study: First, they asked people to give their opinion of a credit lending business based on social media data and what they would think if their bank also accessed their Facebook profiles for data. Second, researchers wanted to find out if people would passively accept their bank searching through their social media information or if they would begin manipulating their profiles so that banks would receive a more favorable impression of them. 271 people took part in the study, all of whom already use online and mobile banking services as well as Facebook. The average age of participants was 26, with the sample ranging from 18 to 64 years of age in total. Survey responders were confronted with a scenario in which, through the use of their cell phone, they were able to easily receive a loan for an expensive gadget at a store within just a few minutes after allowing a bank access to their Facebook profile. Afterwards, it was explained how the bank lending process worked, namely that their profiles were analyzed and therefore personal information about them and their friends was accessed and used. Participants were asked to rate the situation and then they were asked how this experience would influence future behaviors.

As for the results: Many of those surveyed understand that Big Data analysis can be used to supplement the credit approval process. They also recognize advantages to using Facebook data for this purpose: 44 percent could envision better lending conditions. 46 percent expect the process to be faster and 51 percent said it could be more convenient. 31 percent could picture themselves becoming eligible for a loan for the first time through this process. However, 45 percent expect their own personal conditions to worsen. After it was explained to survey participants how the bank reaches its quick credit rating by using their personal data from their Facebook profiles, opinions became even more starkly divided. Only 23 percent found the offer appealing. Participants would decline the process if data from their social networks could result in a negative outcome. If they allow a bank access to their Facebook profile, they want to experience positive results instead of negative consequences. Any other outcome would be perceived as unfair. 64 percent declined to allow a bank access to personal information that they shared with Facebook friends. “Banks who lead the way with these analysis techniques should expect to encounter a great deal of resistance, particularly in the implementation phase,” according to Thießen.

“At the moment, when businesses snoop around in private data for commercial purposes, it’s seen as unfair and unethical. However, many are aware that in the future, it won’t just be banks that are relying on data from Facebook. As more and more businesses use Facebook, it will become even more advantageous to design one’s Facebook profile strategically. Basically, to manipulate it,” estimates Georg Gliem, student. 58 percent of participants said they would pay more attention to what they post, share and “like”. Around one third would delete friends or pay closer attention to correct spelling and grammar. 40 percent would be more deliberate about the friend requests they send. 39 percent would delete certain photos. 30 percent would “like” more career- and education-related pages. “This shows that a portion of Facebook users are prepared to manipulate their Facebook content,” says Markus Neber of the research group. However, not all share this view; “52 percent said they would not delete friends on Facebook. 71 percent said they would not strategically send friend requests to targeted people based on the reputation they have and their perceived ability to boost a credit assessment. 44 percent said that they would not strategically delete photos or remove tags on photos to conform. 34 percent could not see themselves monitoring their tags more closely,” according to student Daniel Wulf. “This means, in summary: the majority of people still shy away from manipulating their Facebook pages, but a significant portion, around 30 to 40 percent would carry out some of these steps,” reports Thießen.

After subjects were shown examples of how a bank can make conclusions based on a person’s social situation, intellectual capabilities and movement profile, their willingness to embellish their Facebook profile increased considerably. Agreement with the phrase “sending targeted friend requests to certain people” increased by 35 percent points. Support for the item “paying more attention to correct spelling and grammar” went up by 28 percent. “We saw changes of around 10 to 20 percent in all of the criteria we asked about – including, for example, willingness to delete photo tags or the photos themselves, “liking” pages that could be advantageous for receiving a loan or the incentive to divulge information about their location,” Thießen reports. According to the Chemnitz-based researchers, all of these statements attest to how willing people are to see Facebook less as an aspect of their personality, but rather as an instrument to be used to their advantage.

“When a tool can transition from what is initially a social function to a commercial one in just a few years, that allows us to make conclusions about underlying motivations in society and disappoints people. The network developers who originally pursued their idea of bringing friends together could not resist giving in to their greed and developing commercial aspects. Facebook users respond, as our study shows, with a willingness to present their personality in a distorted way in order to obtain as many – commercial – advantages as possible,” says Kühn. According to Thießen, no one can avoid the question of whether users should dedicate their entries in their social network more to maintaining friendships or to other purposes: “Anyone who puts contact with friends above all else has to live with the consequences and potentially seal themselves off from data analysis such as credit rating appraisals. However, this will become more and more difficult as Big Data technologies continue to spread.”

More information is available from Prof. Dr. Friedrich Thießen, Telephone 0371 531-26190, E-Mail finance@wirtschaft.tu-chemnitz.de

(Author: Prof. Dr. Friedrich Thießen, Translation: Sarah Wilson)

Mario Steinebach

04.08.2016