Financial Mathematics, Bachelor of Science (B.Sc.) / Master of Science (M.Sc.)

| Standard period of study: |

|

| Start of studies: |

|

| Entrance requirement: |

|

| Language: |

|

Application

There is no admission restriction for this degree program. Application is made online. The respective study program is called "Mathematik". (For the Master phase one has to select the option "konsekutiver Master" in "Form des Studiums".) The choice of the field of study, whether Mathematics, Mathematics with Computer Science, Industrial Mathematics, Financial Mathematics oder Business Mathematics is made later after the start of studies without any bureaucracy.Applications can be sent in until shortly before the start of the semester, see also term deadlines.

The change to another field of study is generally possible during the studies. Please consider the special features of the minor subject respectively the technical minor subject of the other fields of study. It is recommended to contact your academic advisor .

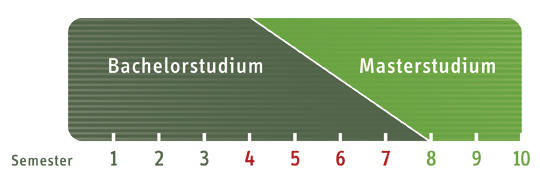

If one decides during the Bachelor to continue with the Master studies in the combined Bachelor/Master degree program, one can already attend courses

of the Master phase during the Bachelor phase, whose successful passing will be accredited in the Master program. This method prevents delays

in the timing of the studies which otherwise might arise in the organization of the transition from the Bachelor to the Master studies.

If one decides during the Bachelor to continue with the Master studies in the combined Bachelor/Master degree program, one can already attend courses

of the Master phase during the Bachelor phase, whose successful passing will be accredited in the Master program. This method prevents delays

in the timing of the studies which otherwise might arise in the organization of the transition from the Bachelor to the Master studies.

Bachelor study program Financial Mathematics within the combined program

The study program conveys a solid mathematical and economical basics at the beginning. Built upon these basics, the students learn the mechanism behind financial instruments and the principles of the pricing at financial markets. Furthermore, they hear how insurance money is calculated and which mathematical methods are useful in investment banking. In order to live up with the diverse emphases, the Bachelor study program Financial Mathematics offers a notable flexibility. This allows the student to choose the specialization according to his own preferences, like in lectures in financial mathematics, stochastics as well as in the business administration or the computer science.The Bachelor study program is finished with the Bachelor thesis, which is normally in the 6th semester of the study program.

Master study program Financial Mathematics

The Master study program deepens the knowlegde of the Bachelor studies on a broad basis. For example, lectures from the fields Financial Mathematics/Financial Economy or mathematical and economical education can be taken. Here, students profit from the manifold offer in the disciplines mathematics, business administration and computer science at the TU Chemnitz. A short selection of possible lectures follows, a complete list (as well as an exemplary study plan) can be found in the study regulations[de]. OFor example, in the field Financial Mathematics/Financial Economy one can choose fro lectures in portfolio optimization, stochastic analysis, discrete or nonlinear optimization, stochastic processes, insurance mathematics or time series analysis. Additionally, research moduls offer the possibility to take special lectures from the range of lectures of the faculty as well as lectures from the field Mathematical Specialization (see below). In the modules of the field Mathematical/Computational Basis include lectures in funtional analysis, numerics of ordinary differential equations, numerics of partial differential equations, efficient algorithms and data bases. The field Mathematical Specialization contains lectures like graph theory, chosen chapters of analysis, Hilbert space methods, inverse problems, convex analysis and variational methods. Furthermore, the modules of the field Economical Education offer a wide range of lectures in the fields of Business Administration, like German Commercial Code/Federal Court of Justice, marketing, micro/macro economics, production management, finance, accounting, controling among others. The Faculty of Business Administration offers an overview on the lectures on their homepage .The Master study program is finished with the Master thesis, which is normally in the 4th semester of the study program.

Bachelor study program Financial Mathematics within the combined program study schedule (B.sc.)[de]

| 1. to 5. sem. | Basic Modules (110–136 LP) |

| 1. to 4. sem. | Computer Science and Business Administration (32–58 LP) |

| 5. to 6. sem. | Specialization and Supplement (0–26 LP) |

| 6. sem. | Bachelor Thesis (12 LP) |

Master study program Financial Mathematics study schedule (M.sc.)[de]

| 1. to 3. sem. | Major Seminar (4 LP) |

| 1. to 3. sem. | Specialization (62–86 LP) (Mathematical/computational base, mathematical specialization, financial mathematics/financial economy and economic broad study) |

| 1. to 3. sem. | Supplement (0–24 LP) (e.g. foreign language, software practical course) |

| 4. sem. | Master thesis (30 LP) |

- banks and insurance companies

- business consulting

- financial service provider

| Regulations and documents | Miscellaneous |

|---|---|

| Academic advisor |

|---|

Prof. Dr. Alois Pichler

|